The air cargo market continued to unwind 18 months of record gains in October as the global economy slows and consumers tighten their purse strings while spending more on services.

The industry is well into the typical peak season with little sign of increased shipping activity. Demand and rates are falling at a time when both normally climb. Cargojet CEO Ajay Virmani this week called the run-up to the holiday shopping events a “controlled peak.”

Volumes in October, measured by a formula that combines weight and shipment dimensions, fell 8% versus the same period last year, the eighth consecutive month of demand decline, market intelligence firm Xeneta reported this week.

The downward trend worsened from September, when volumes contracted 5% year over year and 0.3% versus three years ago.

Performing at last year’s record levels, which were driven by pandemic-related shortages and supply chain disruptions, was not sustainable, but October demand also fell 3% below the level in 2019 — a weak year for air cargo.

The recovery in capacity also stalled. Available belly and freighter space remains 7% below pre-pandemic levels, according to Xeneta, one of the reasons rates remain relatively high.

The extra airlift from the reintroduction of more passenger flights during the summer combined with lower demand means planes are less full — and profitable. Volumetric load factors in October were 61%, 7 points lower than a year ago and 1 point worse than in 2019, Xeneta said.

October global airfreight rates for immediate delivery were below last year’s level for the second consecutive month. A slight uptick in the second half of the month was caused by a rise in rates for special cargo, while general rates continued to slide, Xeneta said.

A modest strengthening in Asia-Pacific export lanes to Europe and North America during the second half of October likely had more to do with a rebound from China’s Golden Week holiday, when factories shutdown and don’t ship, than with a late peak season surge.

The bottom line is that global air cargo rates have tumbled two-thirds since December and about 25% from this time last year to $3.15 per kilogram, but are still almost double the level in 2019 due to the capacity shortage, as well as airline and airport labor shortfalls that constrain flight and warehouse productivity. The fall in air rates is not as dramatic as the one in ocean freight, where easing in port congestion and falling demand has dropped rates by 70% to 85% from a year ago.

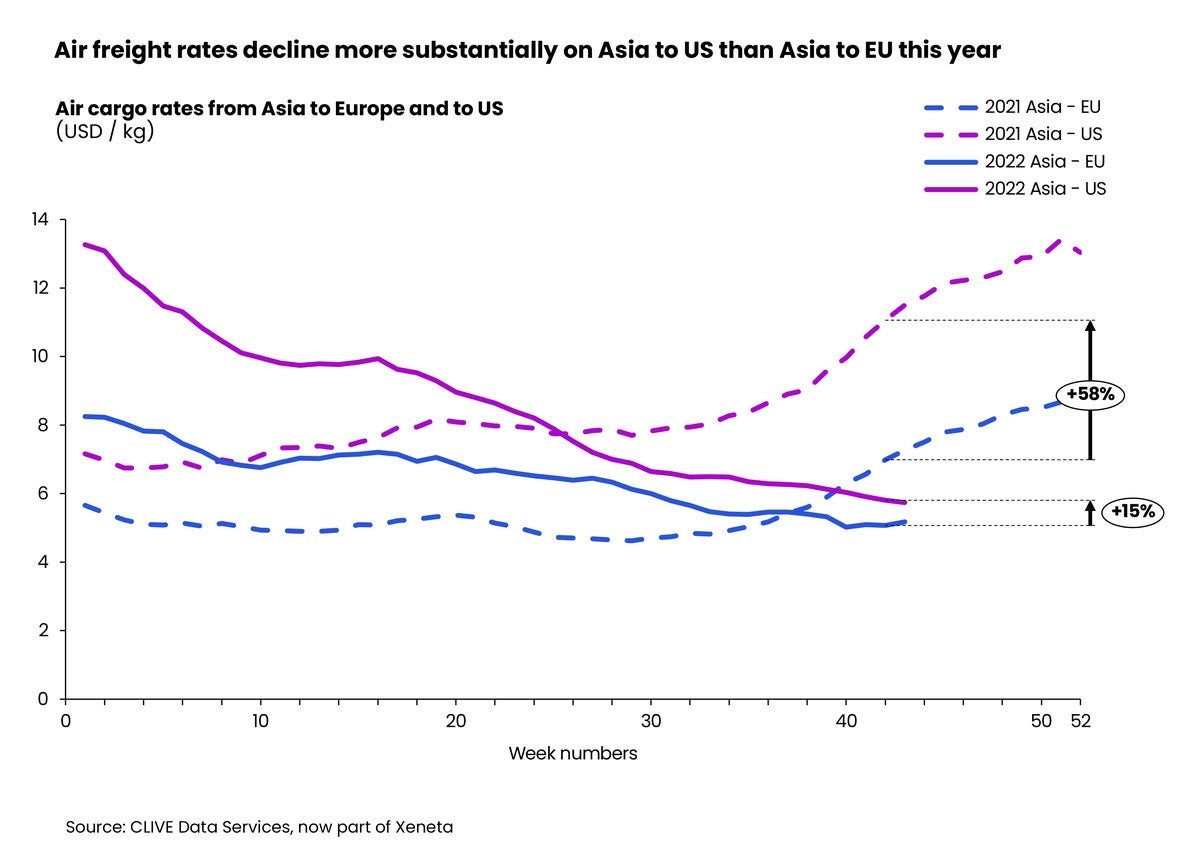

The rate between China and the U.S. West Coast is normally about $2 to $3 per kilogram and about $5 per kilogram during peak season. This year rates are in the $6 range, according to Freightos, an online booking and payment platform for air and ocean freight. Rates in the broader Asia-U.S. market normally run $2 per kilogram until peak season and soared to $13 last year, compared to about $5 last week.

The cost to ship by air from Hong Kong to North America and Europe fell 32% and 13%, respectively, from last year.

Weakness on the South China-U.S. trade lane is reflected by a significant number of charter cancellations by logistics providers, Flexport said in a customer update, while charters are being added for European destinations.

Rates from Asia to Europe have held up more than to North America because of the added costs for EU routes due to the closure of Russian airspace, Xeneta noted.

Europe-to-U.S. airfreight spot rates stood at $3.11 per kilogram in October, down 27% from the 2021 level, while Asia-to-Europe rates fell 25% to $5.09 per kilogram, according to Xeneta data.

Asia-U.S. registered the sharpest decline among the three top volume corridors, with the average spot rate down 45% from October last year.

Air logistics professionals have lowered expectations for 2023 as consumers spend less on goods, export manufacturing contracts and cargo shifts back to cheaper ocean services where space is abundant again on many trade lanes. With so much economic and geopolitical uncertainty, predicting the direction of cargo rates in the new year will be difficult.

New cargo supply

Airlines are adding more cargo capacity on several routes. Air Canada recently announced an increase of flight frequencies from Toronto to Dubai, Mumbai, India and Lima, Peru, which began Tuesday.

IAG Cargo, the cargo division of International Airlines Group, announced the restart of service from Iberia’s hub in Madrid to Caracas, Venezuela, and Rio de Janeiro, utilizing an Airbus A350 and A330-200, respectively, three times per week. Primary exports to Europe are flowers, papayas, mangos and figs.

Delta recently increased frequencies to daily from Atlanta to Buenos Aires, Argentina, with a Boeing 767 and three times per week to Santiago, Chile, using an A350.

Qatar Airways commenced twice weekly freighter operations to Riyadh, Saudi Arabia, with Boeing 777 aircraft.

And Air China will resume its freighter services out of Shanghai Pudong International Airport this month, according to the Flexport notice. Air China’s service has been suspended for several months.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED NEWS:

Airlines fill less cargo space as consumer spending, trade sag

The post Air cargo market continues to deflate under global economic pressures appeared first on FreightWaves.