American Trucking Associations Chief Economist Bob Costello said the estimated driver shortage number is falling, but that trend could be short lived.

American Trucking Associations Chief Economist Bob Costello said the estimated driver shortage number is falling, but that trend could be short lived.

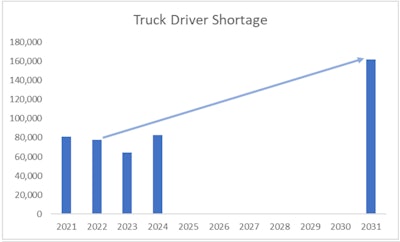

“Based on our estimates, the trucking industry is short roughly 78,000 drivers,” Costello said. “That’s down slightly from 2021’s record of more than 81,000 – but still extremely high historically.”

ATA calculates its shortage estimates by determining the difference between the number of drivers currently in the market and the optimal number of drivers based on freight demand. ATA’s 2022 projection, released Tuesday at ATA’s Management Conference and Exhibition in San Diego, is the second highest level on record.

Costello noted, however, that a 3,000 driver count improvement “is still not enough to make a substantive difference in the shortage – particularly in the long-haul, for-hire truckload sector, the part of the industry most acutely impacted by the shortage,” adding that based on current driver demographic trends and projected growth in freight demand, the shortage could still swell to more than 160,000 in 2031.

Barring economic or supply chain upheaval, Costello expects the looming recession to further suppress the driver shortage number in 2023, reaching its lowest point since pre-pandemic, before shattering the record-high mark in 2024.

The industry needs to hire nearly 1.2 million new drivers over the next decade to replace those leaving trucking, and pay alone likely won’t be enough to keep supply on pace with demand.

Data from ATA released earlier this year shows the average truckload driver made about $70,000 in 2021, including salaries and bonuses but not benefits – an 18% increase in annual compensation from 2019. This data also showed that over 90% of truckload carriers raised driver pay in 2021.

Pay’s overall influence on increasing the driver population has been two-sided. It’s brought a statistically small number of people to the business, but it’s also given current drivers the choice to work less for the same take home pay. Almost 40% of truckload carriers reported to ATA that increases in pay last year resulted in drivers choosing to drive less, make the same amount of money and be home more often.

“We’ve never seen a period before where quality of life is more important for the driver,” Costello said. “I do think we’re getting more people interested in the profession, but I’m not sure what happens when the reality hits them that you go out for five days and you’re home for two.”

The driver shortage this year fell from its perennial top spot on the American Transportation Research Institute’s (ATRI) annual Top Industry Issues report, sliding to No. 2 overall. It remained, however, the top issue for fleet participants in the survey.

Based on current driver demographic trends, as well as projected growth in freight demand, the shortage could swell to more than 160,000 over the next decade.ATA

Based on current driver demographic trends, as well as projected growth in freight demand, the shortage could swell to more than 160,000 over the next decade.ATA