Despite the concern found in the general economy, there wasn’t much talk of the ‘R’ word during FTR Chairman and CEO Eric Starks’ economic industry update at the opening general session of the National Trailer Dealers Association (NTDA) Convention Thursday in Colorado Springs.

Starks opened his presentation by polling the audience and asking how many trailer dealer attendees felt the economy was already in a Capital R recession. He guessed only 5 to 10 percent of attendees raised their hand, but he said their assessment wasn’t without merit. United States’ GDP has fallen in consecutive quarters and Q3 is unlikely to set many records. He said the GDP numbers like that would indicate a recession is here — or close.

But after the events of 2020 and 2021, Starks said analysts can’t really evaluate the economy the same way they did in 2019. The COVID shutdown and restart in 2020 led to many structural economic changes. The U.S. (and global) economy is still finding its way forward in post-pandemic environment.

Business might not feel as great today as it did 12 months ago, but that doesn’t mean a recession is underway. And even if one does arrive in 2023, Starks said FTR data indicates the trailer market should still be healthy in the months and years to come.

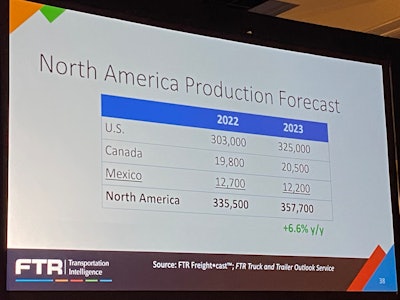

FTR’s North American trailer forecast, presented by Eric Starks at Thursday’s NTDA Convention opening general session.

FTR’s North American trailer forecast, presented by Eric Starks at Thursday’s NTDA Convention opening general session.

In kicking off his presentation Thursday, Starks said FTR has not heard anyone in the trailer and truck sectors announce they have changed their budget for capital investment for 2023, and with truck orders hitting all-time record last month and trailer backlogs remaining above historical norms, it appears equipment demand remains ahead of available supply.

Starks said Thursday that’s particularly encouraging for the trailer space, as production levels appear to be at or close to available peak levels. He said FTR’s production forecast for 2022 is 303,000 units in the U.S. and 335,500 in North America. In 2023 those numbers go up to 325,000 and 357,700 units — a 6.6 percent year over year increase.

[RELATED: Analysts expect softening in freight market in months ahead]

Looking at the dry van, reefer and flatbed markets, Starks said the latter appears to have the most uncertainty — orders recently have slipped as production continues to rise. He said if that continues the flatbed sector may intentionally slow production in the months ahead, but thus far that has not been necessary. In the dry van and reefer sectors, Starks said backlogs have been stable most of 2022 and remain around six months for most OEMs. Historical norms are typically around four months, which Starks said indicates demand remains higher than production capacity. He said that doesn’t happen in a recession.

In addressing the general economy, Starks said there are actually a lot of features in today’s economy that are typically not found in a recession, such as steady consumer spending and savings, low levels of credit card delinquency and a growing job market with “more open jobs than there are people to hire.”

Additionally, Starks noted while interest rates and inflation are definitely rising, other than a brief period in the spring when fuel prices exploded, most consumers and businesses have not drastically altered their financial habits out of fear. Consumer and business confidence might not be quite as strong as its been in 2022, but Starks said a lack of confidence should not equal a recession.

Trucking and the trailer business appears stable entering 2023 and, after the past few years, Starks said that should be reassuring for everyone.