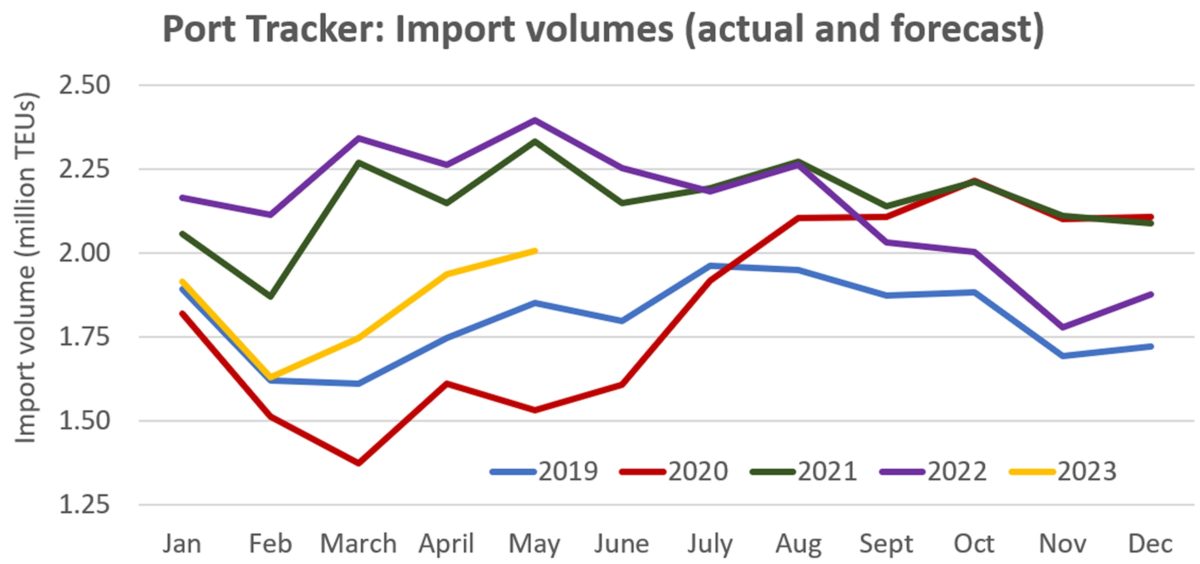

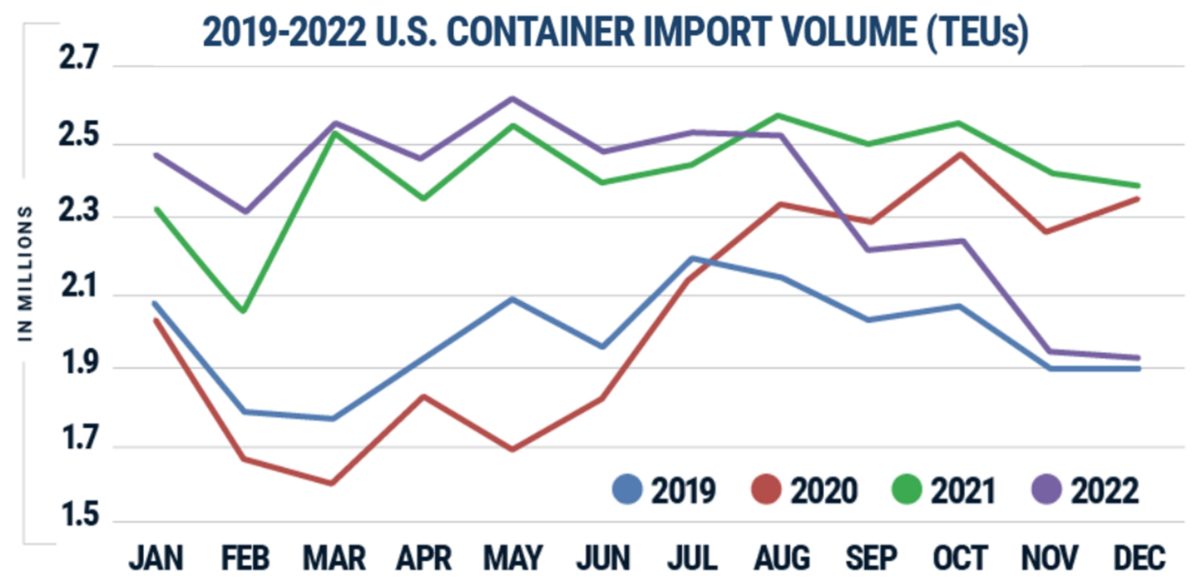

The “new normal” is looking a lot like the old normal as U.S. imports continue to fall. Volumes began declining sharply in September and were already close to 2019 levels by the end of last year. They’re expected to pull even with pre-COVID numbers this month and next.

The “pandemic-driven surge [is] finally over,” said the National Retail Federation (NRF).

The NRF publishes the monthly Port Tracker report together with Hackett Associates. “Import patterns appear to be returning to what was normal prior to 2020,” said Hackett Associates founder Ben Hackett.

Port Tracker covers 12 U.S. ports. While final counts are not in yet, it estimated the ports it covers handled 1.88 million twenty-foot equivalent units in December, down 10.1% year on year.

Port Tracker forecasts that import volumes in January and February will be roughly even with pre-COVID levels then will bounce back above them again in March-May.

Another data provider, Descartes, reported imports for all U.S. ports totaled 1,929,032 TEUs in December, just 1.3% higher than imports in December 2019, pre-COVID.

Last month’s imports were down 19.3% year on year and down 1.3% versus November, according to Descartes.

A FreightWaves SONAR dataset on U.S. Customs import shipments likewise shows a reversion to pre-pandemic conditions. Shipments are now back to 2019 levels.

Not all back to normal

Countrywide volumes are close to pre-boom levels, but there are still some big differences.

Ocean schedules have improved, but delays remain higher than they used to be. In the first week of January, the Flexport Ocean Timeliness Indicator for the Asia-U.S. route was still 25% higher than three years ago.

The coastal mix is also much different. Ports on the East and Gulf coasts continue to handle significantly higher volumes than before the pandemic. Volumes on the West Coast are much lower than they used to be.

A new West Coast dockworker labor contract has still not been signed, over seven months after the last one expired.

“The continuing labor uncertainty could be a significant reason why import volumes are not shifting back to major California ports despite their improving situation,” said Chris Jones, executive vice president of industry and services at Descartes.

The COVID-19 situation in China presents another ongoing complication for supply chains. “COVID infection is widespread and given that the Chinese population has little to no immunity, the impact of COVID on manufacturing supply chains could continue for quite some time,” noted Jones.

There could also be another inventory effect ahead — this time in the opposite direction. In 2022, importers brought in too much; at some point in 2023, they may find they have too little.

“People … will see that underlying consumer demand is actually relatively healthy and all of a sudden, they’ll become concerned that their inventories are a bit on the low end and we’ll possibly see a bounce-back,” said Hapag-Lloyd CEO Rolf Habben Jansen last year.

Hackett predicted, “As inflation eases and consumer spending returns, we project that growth will slowly return going into the second half of the year.”

Click for more articles by Greg Miller

Related articles:

- Coast is (almost) clear as port congestion fades even further

- Top 10 container lines: How did rankings change during boom?

- Chance that container ship arrives on time is still a coin toss

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- LA/LB imports drop double digits; slump predicted through spring

- Here’s how container shipping lines can escape a crash in 2023

The post ‘Surge finally over,’ US imports back near pre-pandemic levels appeared first on FreightWaves.